Buyer Beware: Look Out for Hidden Fees from National VoIP Providers

If you’re an IT consultant, you know how important it is to provide solid recommendations when your clients ask about VoIP providers. After all, when you personally recommend a company that ends up being disappointing to your clients, you end up looking bad as well.

If you’re currently suggesting any of the six large national providers (Vonage, RingCentral, Jive Communications, Nextiva, Verizon, or 8x8), you should be aware of some of the taxes, fees, surcharges, and “other” charges—over and above initial quotes—that clients are routinely encountering on their invoices. These numbers should help you get a better sense of what your clients’ monthly bills will actually look like with these providers.

1. Vonage

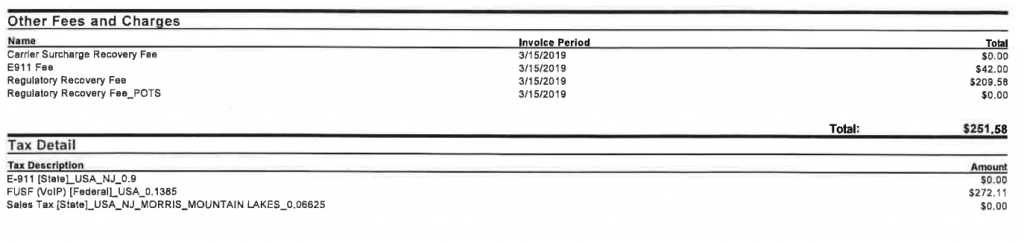

Example Vonage Invoice:

Service Charge Total: $1,781.00

Taxes, Fees, and Other Charges Total: $523.69 (Taxes: $272.11; Other Fees and Charges: $251.58)

Percentage of Bill That’s Taxes: About 11.6 percent

Percentage of Bill That’s Fees and Other Charges: About 10.7 percent

Some things to watch for:

As stated on the Vonage website, the RCIP fee is not a government-mandated fee. It’s a fee Vonage uses to cover certain costs associated with regulatory agency compliance, patent protection, trademark filing, copyright registrations, fraud prevention, and more.

-Cost: $3.99 per voice line, fax line, virtual number, toll-free number, and SoftPhone

This is also not a government-mandated fee but a Vonage-specific fee. It covers 911 service and unlimited 411 directory assistance.

-Cost: $1.99 per line (fax, voice, and SoftPhone); plans that don’t charge this fee are billed at $1.49 per 411 call

This fee recovers Vonage’s contributions to the Federal Communications Commission (FCC), as well as the federal Universal Service Fund (USF).

-Cost: As of April 1, 2019, the rate is 12.3 percent

Certain taxes and fees are justified and unavoidable, and state-specific taxes fall under that category. Whatever your provider, expect some of these fees. Your provider, however, should be up-front about these costs and, ideally, should include them in the initial proposal.

-Cost: Varies by state; in New Jersey, for example, state sales tax is 6.625 percent, and the state 911 fee is $0.90 per line

2. RingCentral

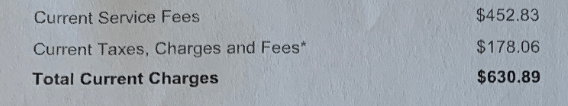

Example RingCentral Invoices:

Service Charge Total: $452.83

Taxes and Fees Total: $178.06

Percentage of Bill That’s Taxes, Fees, and Other Charges: About 28.2 percent

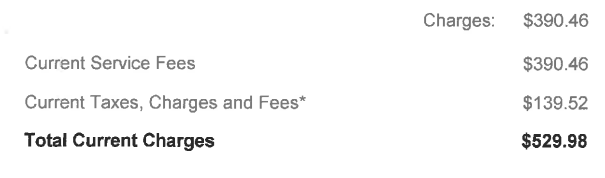

Service Charge Total: $390.46

Taxes and Fees Total: $139.52

Percentage of Bill That’s Taxes, Fees, and Other Charges: About 26.3 percent

Some things to watch for:

As stated on the RingCentral website, this fee is not a tax, and no government or government agency mandates its charge. The charge recovers RingCentral’s costs associated with federal, state, and local filing requirements; subpoenas and civil litigation demands; protection of intellectual property; and more.

-Cost: Not specified on the RingCentral website, but the fee amounts to $3.00 per seat

This fee covers RingCentral’s contributions to the federal Universal Service Fund, which offers telecommunication options at a reasonable cost to income-eligible consumers. Per the website, “RingCentral is permitted, but not required, to recover these costs from its customers.” In other words, RingCentral is technically allowed to recoup this money by charging its customers, but it’s not required of them.

-Cost: Not specified on the RingCentral website

These are two separate fees. The e911 fee (not government mandated) covers RingCentral’s costs associated with providing 911 services; the 911 fee is a local government charge used to pay for services like rescue and fire.

-Cost: Not specified on the RingCentral website, but the 911 fee amounts to $1.00 per seat

These costs are imposed by various levels of government, and they vary according to your state, province, and municipality. Providers have no control over these kinds of taxes.

-Cost: Varies

3. Jive Communication

For an idea of the fees, taxes, and surcharges added to a Jive Communications invoice, please see this report for the state of California: Breakdown of Services Taxes, Fees, Surcharges, and Surcredits Report.

Remember, many of these extra charges are state specific, so the fees you’ll be subject to (and the amount of those fees) will vary by state.

4. Nextiva

Some things to watch for:

This charge offsets Nextiva’s costs associated with governmental inquiries and obligations, as well as any legal and billing expenses related to those. It is not a government-mandated tax or fee.

-Cost: Not specified within Nextiva’s terms and conditions or website, but the RRF amounts to $3.25 per line

This charge offsets Nextiva’s costs associated with funding the infrastructure that supports various aspects of emergency services.

-Cost: Not specified within Nextiva’s terms and conditions or website, but the E911 fee amounts to $1.00 per line

This fee covers Nextiva’s contributions to the federal Universal Service Fund, which offers telecommunication options at a reasonable cost to income-eligible consumers.

-Cost: Not specified within Nextiva’s terms and conditions or website, but the USF amounts to 17.4 percent

For a full discussion of Nextiva’s terms and conditions, read here. (Section 10 deals specifically with “Fees and Charges.”) For a discussion of taxes, surcharges, and fees, including state-specific numbers, read here.

5. Verizon

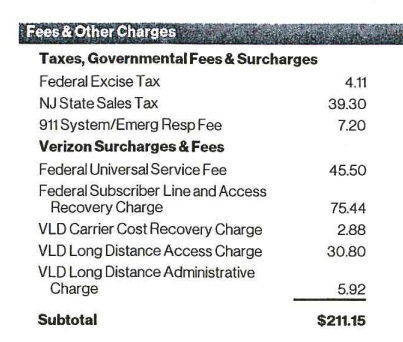

Example Verizon Invoice:

Service Charge Total: $702.58

Taxes and Fees Total: $211.15

Percentage of Bill That’s Taxes, Fees, and Other Charges: About 23.1 percent

Some things to watch for:

This charge offsets Verizon’s fees associated with the Federal Communications Commission (FCC). It is not a government-mandated tax or fee.

-Cost: Not specified on the Verizon website

This offsets Verizon’s costs associated with providing emergency services.

-Cost: Not specified on Verizon’s website, but it’s either charged per telephone access line or as a percentage of revenue

This fee covers Verizon’s contributions to the federal Universal Service Fund, which offers telecommunication options at a reasonable cost to income-eligible consumers.

-Cost: Not specified on Verizon’s website, but it’s not charged to Lifeline customers

This surcharge offsets Verizon’s costs related to various regulations at the federal, state, and local levels.

-Cost: Not specified on Verizon’s website

This surcharge offsets Verizon’s costs related to reimbursement to long-distance companies.

-Cost: Not specified on Verizon’s website, but the charge applies to each phone line

This monthly line charge offsets Verizon’s costs related to providing voice services. It is not a government-mandated tax or fee.

-Cost: Not specified on Verizon’s website

Per Verizon’s customer agreement:

What Charges are set by Verizon?

Our charges may also include Federal Universal Service, Regulatory and Administrative Charges, and we may also include other charges related to our governmental costs. We set these charges; they aren't taxes, they aren't required by law, they are not necessarily related to anything the government does, they are kept by us in whole or in part, and the amounts and what they pay for may change.

6. 8x8

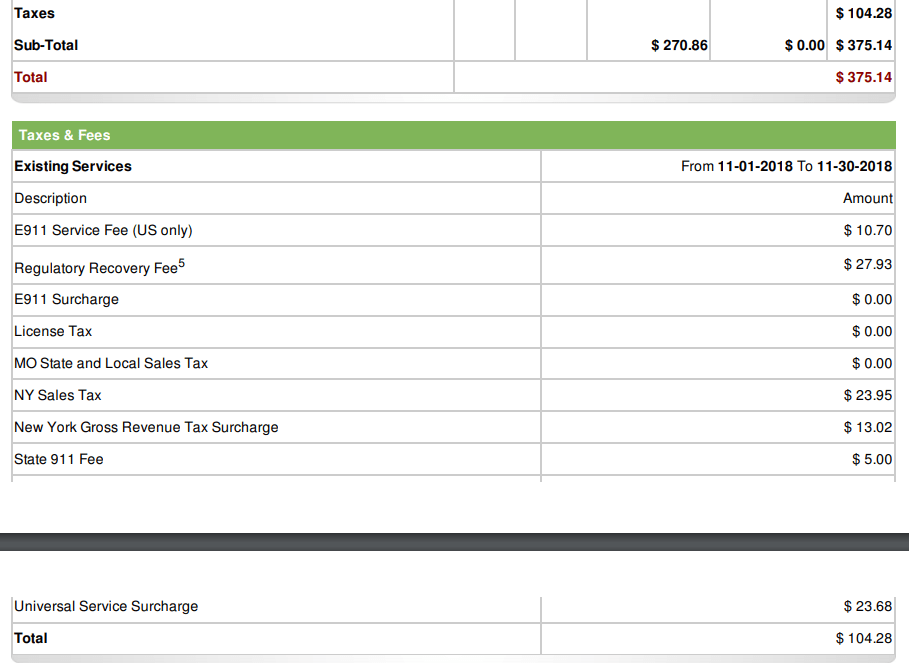

Example 8x8 invoice:

Service Charge Total: $270.86

Taxes and Fees Total: $104.28

Percentage of Bill That’s Taxes, Fees, and Other Charges: About 27.7 percent

For a full discussion of 8x8’s terms and conditions, read here. (Section 2.3.1 deals with the “Customer Subscription Commitment,” Section 6 discusses “Taxes,” and Section 7 covers all “Billing and Payment” issues.)

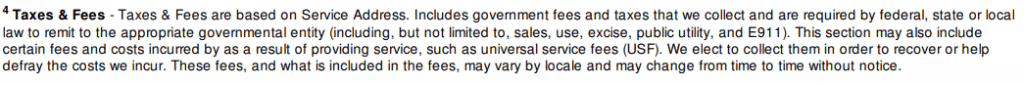

Wording from an 8x8 invoice discussing taxes and fees:

The frustrating thing about all these taxes, fees, and surcharges is that clients can’t do anything about them. For one, they’re often stuck in contracts, and two, the companies are technically allowed to assess these charges. Customers also agree to these charges when they sign a company’s terms and conditions (those long documents full of fine print that nobody reads).

As a customer, there’s nothing more disheartening than getting a quote from a company, agreeing to the stated price, and then receiving an invoice that’s significantly (and mysteriously) higher than that agreed-upon number. While the large national providers seem to practice this pretty much across the board, it’s important to know (as an IT consultant who routinely makes recommendations that ultimately reflect back on you) some VoIP providers are committed to pricing transparency. At Tele-Data Solutions, we don’t add mystery surcharges that aren’t mandated by federal, state, and local governments, and we find this keeps our clients, as well as our IT partners who recommend us, happy.